FY23 saw the addition of 28 new partnerships; Renewal of 34 existing collaborations.

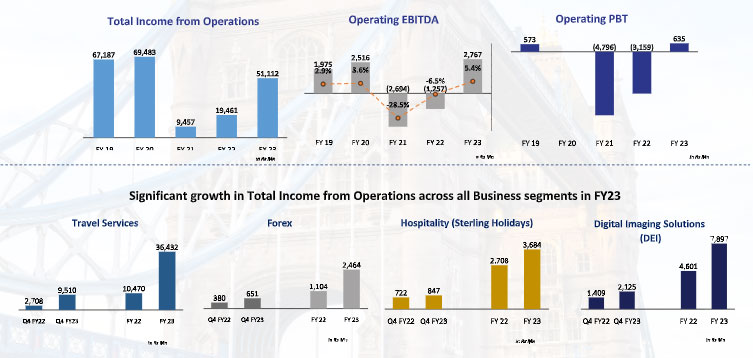

MUMBAI – The Group’s Operating EBITDA grew significantly to Rs. 2.7 Bn for FY23 against a loss of Rs. 1.2 Bn in FY22. Growth driven by Foreign Exchange & Travel Businesses (Thomas Cook); Hospitality (Sterling Holidays).

Highlights

- Highest Operating EBITDA & Operating PBT for Thomas Cook in a decade. Operating EBITDA at Rs. 1.2 Bn for FY23; Operating PBT at Rs. 560 Mn Vs a loss of Rs. 1.14 Bn in FY22

- Sterling Holidays registered Highest EBITDA & PBT since inception: EBITDA at Rs 1.1 Bn for FY23; PBT at Rs. 659 Mn Vs Rs. 436 Mn in FY22

- Consolidated Total Income from Operations grew YoY by 163% in FY23 to Rs. 51 Bn

- Robust growth across all business segments in FY23; Income from operations growth (YoY): Forex: 123%, Travel: 248%, Hospitality (Sterling Holidays): 36%, Digital Imaging Solutions (DEI): 72%

- Focus on Cost Optimization saw annualized savings of Rs.3.71 Bn for FY23, representing a 20% reduction in costs Vs FY20 (Pre Pandemic). The Group maintains a strong financial position, with Cash & Bank balances of Rs. 10.1 Bn as of March 31, 2023.

Highlights for Q4 FY23

- The Group’s Operating EBITDA at Rs. 518 Mn Vs Rs. 239 Mn in FY22

- Standalone Operating EBITDA for TCIL at Rs. 205 Mn Vs Rs. 28 Mn for Q4 FY22

- For Q4 FY23 Consolidated Total Income from Operations grew by 150% YoY to Rs. 13.2 Bn

Travel Services

- Leisure Travel: Sales growth of 235% YoY; recovery of 42% vs. pre pandemic levels

- MICE: managed over 600 groups; 23 events for G20 Summit; 20,500 customers for Khelo India

- Corporate Travel turnover grew by 213% YoY; acquired 57 accounts

- Travel Corporation (India) Limited: Recovery of 53% in turnover for FY23 Vs pre pandemic

- All overseas DMS units registered significant trading volumes for the year

Forex

- Retail growth: 81% YoY; Recovery 97% Vs pre pandemic

- Overseas Education: 162% YoY; 38% growth Vs pre pandemic

- Enabled UPI transactions for foreign nationals from G20 nations in collaboration with Pine Labs & NPCI

- New prepaid card issuance: up by 228% YoY; 29% Vs pre pandemic

- Card loads grew by 172% YoY

- Launched FX Now: Corporate booking tool and B2C mobile app

Hospitality (Sterling Holidays)

- 9th consecutive profitable quarter

- Highest revenue recorded: Rs 3.6 Bn (36% growth Vs pre pandemic)

- Annualised Growth Vs pre pandemic: 39% growth in ARR; 55% growth in F&B spend

- FY23: 184 Rooms added; 6 Resorts

- Guest ratio increased to 62% Vs 47% (pre pandemic), increasing topline growth

Digital Imaging Solutions (DEI)

- FY23 saw the addition of 28 new partnerships

- Renewal of 34 existing collaborations

- Operational launch of 8 key projects and introduction of own B2C attraction

- Commenced operations at 8 key attractions

- Selected as imaging partner for Festive Events in the UAE

Mr. Madhavan Menon, Chairman and Managing Director, Thomas Cook (India) Limited said, “I am delighted to share the strong results for FY23 for the Group, with a record Operating EBITDA at Rs. 2.7 Bn Vs a loss of Rs. 1.2 Bn in FY22. Total Income from Operations also grew annually by 163% in FY23 to Rs 51 Bn. This commendable performance, was led by Thomas Cook India – registering its highest Operating EBITDA & Operating PBT in a decade & Sterling Holidays – recording its highest EBITDA & PBT since the company’s inception. Our focus through the year has been on driving trading volumes, margin expansion, improved productivity via digital solutions and effective cost optimization measures to achieve this. Given the strong forward booking funnels, across business segments & geographies, we are confident of a strong performance in the coming quarters as well.”

Business Segment-wise Performance:

1. Foreign Exchange

- Strong Retail growth: 81% YoY; recovery 97% Vs pre pandemic

- Overseas education segment at 162% YoY; growth 38% Vs pre pandemic

- On-boarded 572 new B2B partners for FX Mate in FY23

- Launched FX Now – Corporate booking tool and B2C mobile app offering a suite of Foreign Exchange services to customers on the go

- Enabled UPI transactions for foreign nationals from G20 nations in collaboration with Pine Labs and NPCI – at all airport counters and retail outlets pan India

- New prepaid card issuance up by 228% YoY; growth of 29% Vs pre pandemic

- Card loads grew by 172% YoY

2. Hospitality (Sterling Holidays)

- 9th consecutive profitable quarter

- 19% growth in EBITDA for FY23 Vs FY22; 6x growth Vs pre pandemic

- On a YoY basis: 39% growth in ARR; 55% growth in F&B spends

- Occupancy was at 58% for Q4 FY23

- Guest ratio to members grew by 62% Vs 47% pre pandemic; 59% YoY giving an upside on revenues

- Resort revenues increased by 70% Vs pre pandemic; 43% YoY

- Expanded and scaled distribution of resort inventory and room rates using Sterling One platform that added significant volumes to existing business

- New resorts launched in Q4 FY23: Chail and Haridwar

- Accelerated focus on digitalisation: Sterling One platform for bookings on the go, Robotic automation tool, bots facilitating efficiencies at an operating level, Cloud based PMS

3. Travel Services

- Corporate Travel

– FY23: Travel turnover grew by 213% YoY; surpassing pre pandemic levels for the quarter

– Acquisition of 57 new accounts across sectors like Engineering, IT/ITS, Manufacturing, Media-Entertainment, Telecommunications, Automobiles, Banking & Finance, Consulting, Oil & Gas, Infrastructure, etc.

– Over 50% adoption by clients on the corporate self-booking tool - Meetings-Incentives-Conferences-Exhibitions (MICE)

– FY23: Significant growth of 711% YoY; 85% recovery Vs pre pandemic

– Managed over 600 groups – including sizeable movements of between 100 to 3000 delegates

– Empaneled as event partner for the G20 Summit; 23 events managed across 20 cities

– Handled 20,500 customers for Khelo India 2023; managed Digital Yoga Exhibition for Govt. of India; event for ground breaking ceremony for world’s first World Health Organization (WHO) Global Centre for Traditional Medicine

– Sporting Events: multiple corporate groups for T20 World Cup and FIFA World Cup 2022

– Several Inbound groups and event in NCR and Mumbai – 6700 delegates from over 130 countries - Leisure Travel

– FY23: Marked improvement in sales with 235% YoY growth; recovery of 42% Vs pre pandemic levels

– Launched new chatbot backed by ChatGPT

– Readymade Holidays designed for new age travellers seeking experiences, with immediate end-to-end fulfillment

– With the fall in average age of customers, launched a new campaign focusing on Gen Z

– Strong focus on Domestic Tourism – including spiritual tourism, outdoor-adventure trips, etc.

– Introduced Easy Visa Holidays to short haul outbound destinations to counter visa challenges for long haul

– Introduced new destinations like Greenland, Vietnam, Iceland, etc.

Destination Management Services Network

- India – Travel Corporation (India) Limited: Recovery of 53% in turnover for FY23 Vs pre pandemic. The top 5 markets for the quarter were UK, France, Russia, Germany and USA contributing 61% of the overall business. Forward pipeline is robust with the expectation of surpassing pre pandemic levels in FY24 Sita’s 60th anniversary celebrated across the office network with the launch of Travart (new digital future ready platform) on March 23, 2023

- Middle East – Desert Adventures saw significantly higher volumes during the year as compared to previous year primarily driven by CIS countries, OTA business, LATAM and India markets. MICE has also shown healthy volumes during the year

- Private Safaris:

– East Africa – Healthy sales throughout the year supported by good volumes from traditional markets such as Germany, US, UK, France. Decent volumes were also seen from France, Romania and India. Due to strong financial performance, the entity repaid the entire outstanding balance of its parent loans which were taken for supporting operations during the pandemic

– South Africa – Key European markets saw volumes gradually increase during the year which resulted in significantly better performance as compared to previous year - USA – Allied TPro: Volumes during the year were driven by European market and FIT. Entered into a 50:50 joint venture agreement with New World Travel, Inc. in December quarter. The new JV company, Allied New World, was set up to leverage the strengths of both companies to drive productivity and accelerate growth in the post pandemic era

- Asia Pacific – Asian Trails: Sales saw an uptick during the year due to re-opening of key destinations viz. Thailand, Indonesia, Vietnam, Malaysia, Singapore and Cambodia. Gradual increase in sales has resulted in a decent recovery from pre pandemic level especially in last quarter

4. Digital Imaging Solutions (DEI)

- During the year, DEI signed 28 new agreements across various geographies viz. Middle East, India, USA, South East Asia etc. Notable new partnerships were Snow Oman, Sheikh Zayed Grand Mosque, LEGOLAND Malaysia, Trans Snow World Surabaya in Indonesia, Snow Kingdom Hyderabad in India, Museum of Science & Industry, Chicago USA, etc.

- Key partnership renewals were Mandai Wildlife Reserve in Singapore, Mövenpick Resort Kuredhivaru in the Maldives and Wild Wadi Waterpark, UAE

- DEI was the imaging partner for many festive events in UAE, noteworthy being Dubai Festive City Market, Souq Madinat Festive Market, Caesar’s Palace Christmas Brunch, Jumeirah Beach Hotel Christmas Brunch, Atlantis Dubai New Year’s Eve Gala, Madinat Jumeirah’s New Year’s Eve Gala, Jumeirah Beach Hotel New Year’s Eve Gala and Burj Al Arab New Year’s Eve Gala

- In a notable milestone, DEI has launched its first-ever B2C attraction – The Dubai Balloon

Other Key Business Updates

- Focus on Digitalization

The Group’s Digital First strategy saw sustained momentum during Q4 FY23

– Launched the pioneering Green Carpet initiative in association with LTI Mindtree: a global platform to help enterprises manage business travel emissions

– Launch of FX Now, a new gen corporate booking tool and a dedicated B2C mobile-app that offers a suite of Foreign Exchange services on the go. Empowers customers with convenient, customizable and contactless end-to-end foreign exchange solutions

– Integration of the Group’s DMS companies (Asian Trails and Desert Adventures) on thomascook.in; real-time updates via live feed will enable customers to avail best pricing for hotels in the Middle East and South East Asian destinations

– Chatbot functionality has been enhanced to ensure seamless sales process- with a Plan Your Holiday for both Domestic & International trips. Increased usage of 70% MoM

Strong focus in FY23 saw delivery across business lines:

– Launch of automated systems for MICE: sales operation application- “MANTRA” and vendor management – NEWGEN

– Launch of innovative Live Video Connect platform via the Companies’ holiday campaigns – where customers can seamlessly connect with holiday experts via a video call/chat, without having to download any added apps or software

– Introduced Holiday Mate – an online B2B tool to empower travel agent partners to deliver swift, seamless and accurate services to the end consumer

– Enhanced self-service features for holiday bookings on the website and Mobile App

- India Network Expansion

– Leisure Travel: 26 franchise outlets opened in New Delhi, Karnataka, Hyderabad, Goa, Gujarat, Maharashtra, Kolkata, Punjab, Tamil Nadu, Uttar Pradesh and an owned branch in Mumbai

– Foreign Exchange: Franchise outlet opened in Agra; new counter inaugurated at Delhi International Airport; Cochin International Airport agreement extended for 5 years.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.

![[PR] PR_Ascott and Vimut Hospital_2024](https://www.traveldailynews.asia/wp-content/uploads/2024/04/PR-PR_Ascott-and-Vimut-Hospital_2024-400x265.jpg)