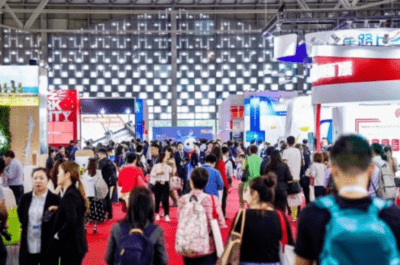

With the emergence of online travel agencies (OTA) and marketplaces and mounting price competition for market-share gains, the supply chain for China's travel industry is being reshaped.

DUBLIN – Research and Markets has announced the addition of the “China Tourism Industry Research Report, 2016-2019” report to their offering.

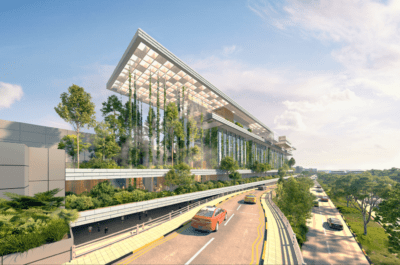

Disposable income growth, demographic change and accelerated urbanization are driving structural growth in China’s tourism industry. Along with favorable government policies, optimized infrastructure and looser visa policies overseas, these factors should underpin 11%/31% 2015-20 CAGRs in domestic/outbound tourists and a 25% CAGR in domestic tourist spending (CNTA forecasts).

With various business models and operating focus, our covered stocks offer different exposures to the underlying drivers of China’s tourism boom: (1) Individual Travel Propensity via leading travel agencies (CITS/CYTS/Caissa/Utour) and destination attractions (Songcheng/CYTS/ CTSHK); (2) Outbound Travel via fully-integrated outbound service platforms (Caissa/Utour); (3) Theme Park Boom via local players with scalable business models and local demand knowledge (Songcheng); (4) Travel Retail via duty free operators with nationwide licenses (CITS).

With the emergence of online travel agencies (OTA) and marketplaces and mounting price competition for market-share gains, the supply chain for China’s travel industry is being reshaped. Market leaders are consolidating tourism resources both vertically (via acquisition of outbound destination resources and/or specialization in resorts/theme parks/travel retail) and horizontally (via O2O integration and/or network expansion to increase scale). This results in various financial profiles accompanying robust earnings growth, incl. high capital returns with superior margins (Songcheng), margin ramp-up with business transformation (CYTS), asset-heavy yet decent margins (CITS), and strong top-line and fast asset turnover (HNA-Caissa and Utour).

Key Topics Covered:

1. Structural growth in China’s tourism industry

1.1 Boom in Chinese travel

1.2 Drivers of the structural growth

1.3 Favorable government policies

1.4 Looser visa requirements

2. Segment markets of China’s tourism industry

2.1 Individual travel for depth and personalization

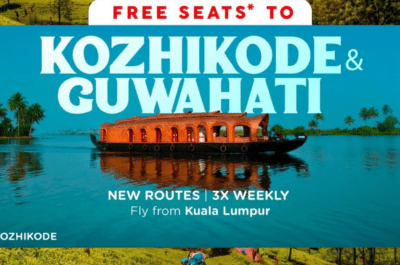

2.2 Outbound travel

2.3 Theme park boom

2.4 Duty free shopping

3. Competitive Landscape

4. Developing new businesses

4.1 Sports Tourism – fastest-growing segment in travel industry

4.2 Medical Tourism – a trend for emerging middle class

4.3 Cruises – a new form of vacation tourism

5. Major industry challenges and risks

TravelDailyNews Asia-Pacific editorial team has an experience of over 35 years in B2B travel journalism as well as in tourism & hospitality marketing and communications.