New research shows that the island’s hotel market has returned to pre-pandemic levels.

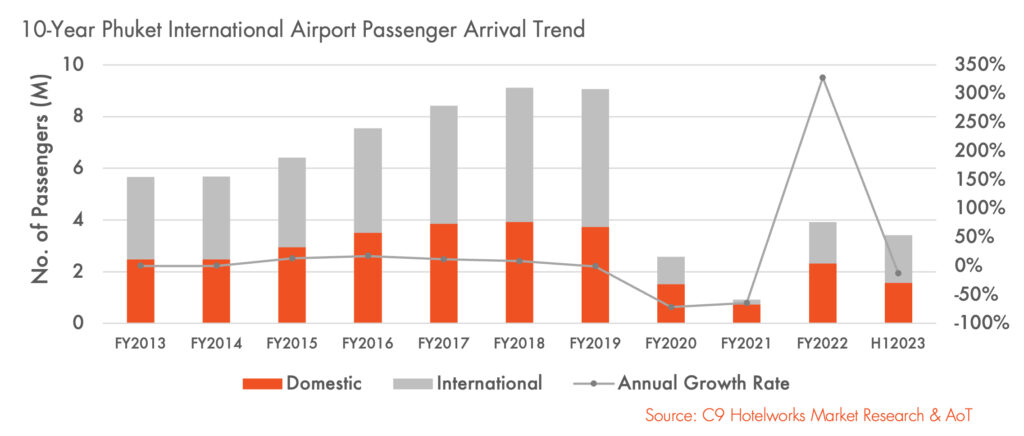

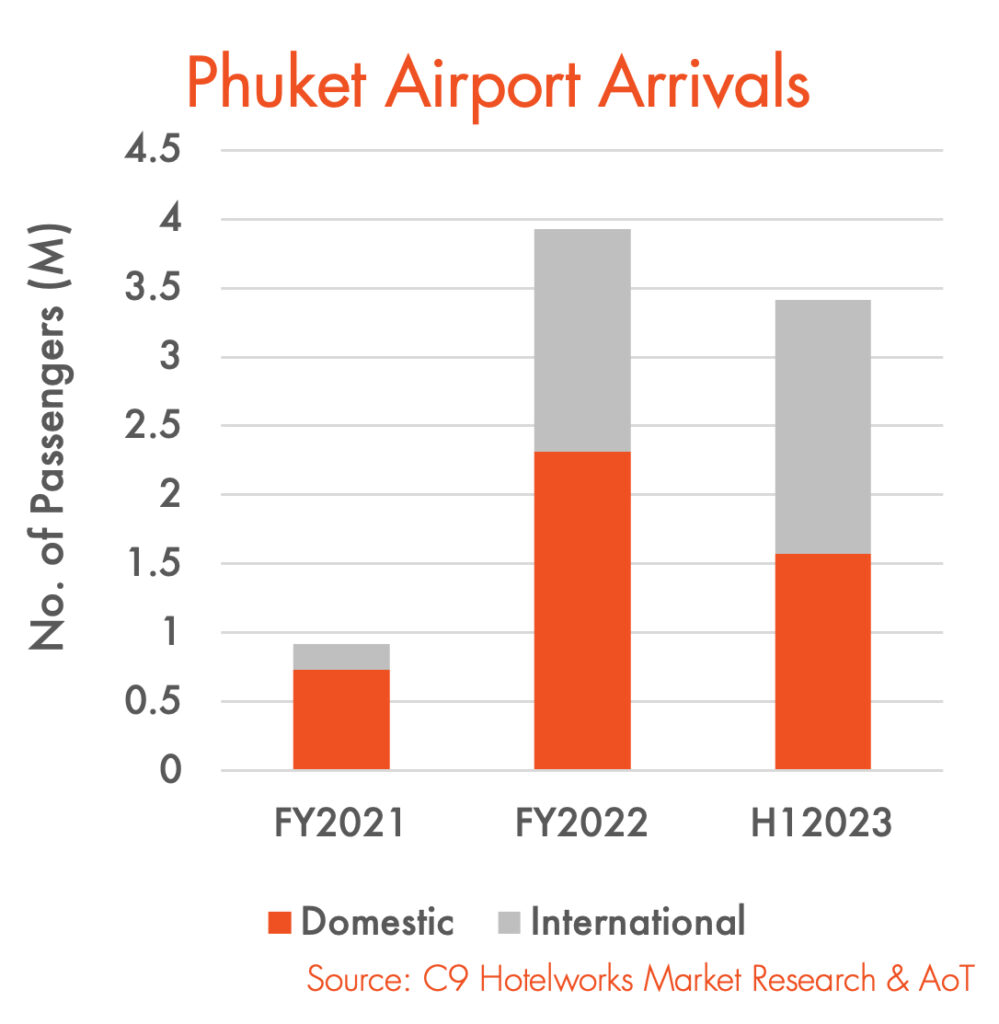

PHUKET, THAILAND – Phuket hotels experienced promising momentum for the first half of 2023, which has set an optimistic path for the remainder of the year. At the mid-year juncture, international and domestic flight volume was already up 75% over total flights in 2022.

Russia and China led the way as the two top tourism source markets in the first six months of the year according to research from C9 Hotelworks in their new Phuket Hotel Market Update report. Rounding out the top 5 overseas marketplaces were India, Australia and Kazakhstan.

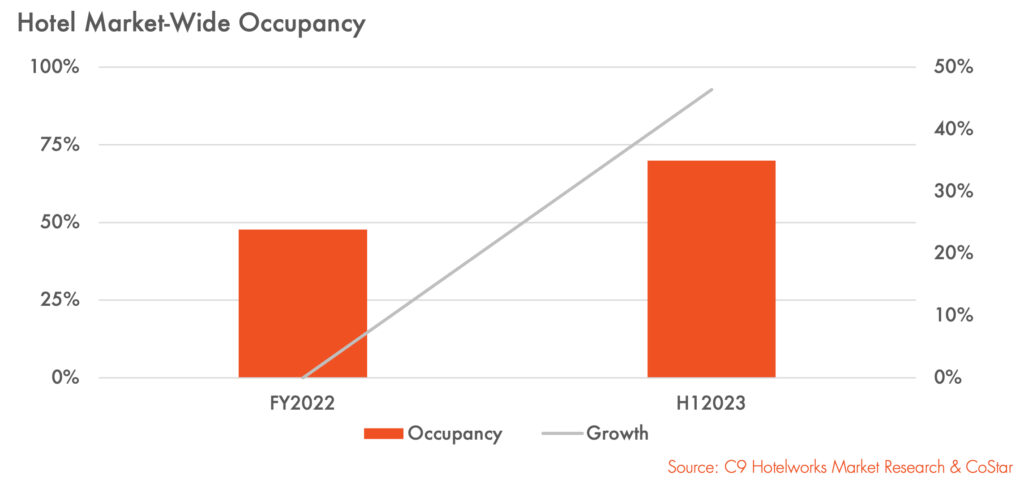

Market-wide hotel occupancy in H1 surpassed the 70% threshold but the real boost for hotel owners has been a sustained post-pandemic trend in higher room rates. While business has returned to usual for much of the over 2,000 Phuket registered accommodation establishments encompassing 106,000 rooms, hotel owners and operators have been plagued by recurring staff shortages.

With Phuket’s hotel market roaring back this year and year-end forecasts likely to exceed pre-COVID-19 levels, there is mounting concern over the resort island’s failing infrastructure. A surge in full and part-time residents – driven by a sharp uptick in tourism, an overheating property market and wholesale return of development activity – has created massive traffic issues that are a threat to long-term growth.

Speaking to the situation, C9 Hotelworks Managing Director Bill Barnett said “High season 2023/2024 is likely to see a “carmageddon”, traffic gridlock scenario that will have a profound impact on tourists and residents alike. The absolute failure to bring transportation infrastructure projects from paper to reality over the past decade will have long-term repercussions.

“Key projects that have not found their way forward include the Patong-Kathu tunnel, cross-island expressway and light-rail (LRT). While the current government has made all the right noise about making these projects a priority, there is no public sector funding capacity at present. This effectively means that a series of public-private partnerships or BOT (build-operate transfer) projects are needed to move these to the execution stage. This includes the much-needed Andaman International Airport.”

Looking towards the coming winter peak period, C9’s market research has revealed that both hotels and tourism businesses remain deeply concerned over the slow return of Chinese travelers. Thailand’s image has been damaged in this enormous market, and travel sentiment to the Kingdom is muted despite a visa-free initiative. With China’s recovery a work in progress, most hotels are looking to strong demand from Russia, Kazakhstan and India, along with traditional ‘snow bird’ seasonal travelers.

Despite strong underlying fundamentals for Phuket hotels, C9’s Bill Barnett is quick to point out, “the first-aid, band-aid approach by the public sector to tourism simply won’t work in a mature international destination that Phuket has evolved into. For nearly two decades the island’s private sector has outgrown antiquated provincial infrastructure and what is desperately needed is a master plan and strategy that can fast-track an ailing infrastructure backbone.”

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.

![[PR] PR_Ascott and Vimut Hospital_2024](https://www.traveldailynews.asia/wp-content/uploads/2024/04/PR-PR_Ascott-and-Vimut-Hospital_2024-400x265.jpg)