Steady rise in recurring fee income and enlarged asset size strategically position lodging business as a growing contributor to CapitaLand’s earnings.

Singapore, 15 July 2019 – CapitaLand’s wholly owned lodging business unit, The Ascott Limited (Ascott), is accelerating its growth globally with the signing of 26 properties with over 6,000 units across 22 cities and 11 countries. The properties, which will open in phases from 2019 to 2023, are mostly signed under management contracts, with three on franchise agreements. To date this year, Ascott has signed contracts for over 40 properties with more than 8,000 units, an increase of over 40% in units compared with the same period in 2018. Ascott has also opened 16 properties with over 2,000 units, a 70% increase in operational units compared with 2018.

Mr Kevin Goh, Ascott’s Chief Executive Officer, said: “We are fast-expanding Ascott’s global network of properties as we continue to pursue an asset-light business model to boost our recurring fee income. While we achieve strong momentum in expanding our global lodging business through strategic alliances, management contracts, franchise and leases, we are also accelerating the number of new property openings. For the first quarter this year, our operational units have contributed S$59.7 million of fee income. We are targeting to open over 40 properties with about 8,500 units this year. For every 10,000 serviced residence units signed, we are expecting to earn approximately S$25 million in fee income annually as the properties progressively open and stabilise. Through these growth strategies, we are looking forward to the fee income boost when we achieve our target of 160,000 units worldwide by 2023.”

With the recent completion of the Ascendas-Singbridge transaction, CapitaLand through Ascott has become the sponsor of both Ascott Residence Trust (Ascott Reit) and Ascendas Hospitality Trust (A-HTRUST). Including the assets held under these two hospitality trusts, lodging assets1 under CapitaLand are valued at S$31 billion, equivalent to 25% of the Group’s total assets under management. An announcement proposing to combine the two trusts has been made on 3 July 2019.

Mr Goh said: “The combination of Ascott Reit and A-HTRUST is a win-win for both unitholders as the combined entity will be Asia Pacific’s largest hospitality trust with an asset value of S$7.6 billion, making it a lot more attractive to investors. A larger investment entity tends to trade better, as well as enjoy higher liquidity and greater cost efficiency. The combined entity will also have greater financial flexibility to seek more accretive acquisitions and value enhancements. Ascott as a sponsor can focus on growing and injecting our lodging assets into a single hospitality trust, and recycle capital into new development opportunities. At the same time, Ascott will continue to benefit and participate in the future growth of these quality assets through our sponsored stake in the trust.”

The majority of the 26 new properties are in Asia Pacific, which continues to see strong demand for lodging in tandem with lower cost of travel, improving travel infrastructure and middle-class demographics’ growing disposable income and aspiration to travel. By 2022, global lodging sales are forecast to reach US$812 billion, with Asia Pacific remaining the second largest market2 . International tourist arrivals continue to be driven by stronger economic growth, more affordable air travel and a better visa regime3.

With these new properties, Ascott has made inroads into six new cities across Asia Pacific, Central Asia and Africa. It has forayed into Atyrau in Kazakhstan, Nairobi in Kenya, Yokohama in Japan, Seongnam in South Korea, as well as Cam Ranh and Hoi An in Vietnam. Ascott has also expanded its presence in 14 cities – Melbourne and Sydney in Australia; Chengdu, Dongguan, Guangzhou, Shanghai, Shenzhen, Wuhan and Xi’an in China; Bogor and Jambi in Indonesia; Cyberjaya in Kuala Lumpur; Cebu in the Philippines; and Bangkok in Thailand.

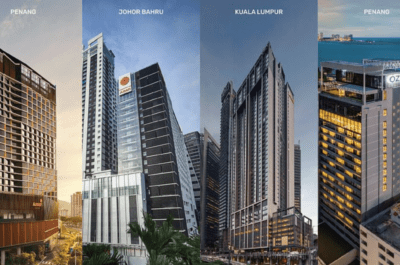

To cater to the burgeoning middle-class segment in the region, Ascott expanded its select service business hotel brand Citadines Connect to Bangkok in Thailand, after Sydney in Australia and New York in the USA. Ascott also brought the hotel brands under TAUZIA, which it has a majority stake in, to countries such as Malaysia and Vietnam, beyond its predominantly Indonesia market. Ascott also signed its fifth Citadines property under its strategic alliance with Nasdaq-listed Huazhu Hotels Group (Huazhu) and Huazhu’s subsidiary CJIA Apartments Group.

In addition to expanding its global footprint, Ascott is strengthening its international marketing network with Ascott Star Rewards – the world’s first loyalty programme in the serviced residence industry to offer full flexibility to earn and redeem points. Member bookings have quickly tripled since the loyalty programme was launched in April 2019. Members of Ascott Star Rewards have a greater choice of properties across the globe as Ascott has opened 16 properties this year, with more than 30 properties scheduled to open for the rest of 2019. Ascott is also gearing up for the opening of its flagship coliving ‘lyf’ property – lyf Funan Singapore – in the city-state’s Civic and Cultural District in September 2019.

Notes:

- Include operating and pipeline properties owned/managed, as well as estimates of third-party owned assets in various stages of development.

- “Trends in Global Travel and Lodging 2018” (2018), Euromonitor International

- “International Tourism Results 2018 and Outlook 2019” (2019), World Tourism Organization

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.

![[PR] PR_Ascott and Vimut Hospital_2024](https://www.traveldailynews.asia/wp-content/uploads/2024/04/PR-PR_Ascott-and-Vimut-Hospital_2024-400x265.jpg)