Ascott has today announced this acquisition and the signing of 13 other properties under franchise and management contracts at the grand opening of La Clef Champs-Élysées Paris in France.

Paris, France — CapitaLand’s wholly owned lodging business unit, The Ascott Limited (Ascott), is investing S$192 million (A$202.2 million) in a freehold serviced residence in the Central Business District of North Sydney through the Ascott Serviced Residence Global Fund (ASRGF), its global fund with Qatar Investment Authority (QIA). To be named Citadines Walker North Sydney, the serviced residence is part of a 48-storey integrated development which also has office and retail components and will be the tallest tower in North Sydney upon its completion in 2021.

Ascott has today announced this acquisition and the signing of 13 other properties under franchise and management contracts at the grand opening of La Clef Champs-Élysées Paris in France. La Clef Champs-Élysées Paris is also one of the assets invested by ASRGF, and comes under The Crest Collection, which comprises some of Ascott’s most prestigious and unique luxury serviced residences. Other assets invested by ASRGF include Citadines Islington London which will open this November, as well as lyf Funan Singapore which has started operations since early September 2019.

Mr Kevin Goh, Ascott’s Chief Executive Officer, said: “This latest acquisition in Australia is in line with our strategy of growing our fund management portfolio through private equity funds, joint ventures and listed hospitality trusts – all of which provide a core asset base for our asset management business. We believe in achieving scale in the business, and fund management is central to the active capital management strategy of Ascott as a dominant lodging real estate player. Ascott enjoys deep presence in many key gateway cities, across various lodging segments, from serviced residences, hotels, coliving apartments to leasing apartments. This provides a ready pipeline of assets like Citadines Walker North Sydney for capital deployment. We have an established owner-operator track record of creating value through sound asset management strategies as well as delivering robust and attractive risk-adjusted returns for our investors. Together with our capacity to co-invest with like-minded capital partners such as QIA, it gives us the ability to stay invested in quality assets for the long term.”

Mr Goh added: “The recent proposed combination of our two hospitality trusts, Ascott Residence Trust and Ascendas Hospitality Trust, will cement Ascott Residence Trust’s position as the largest hospitality trust in Asia Pacific. With Ascott’s sponsored stake in the trust, we will continue to benefit from the properties’ steady yield and participate in their future growth. Likewise, the enlarged trust will continue to enjoy a pipeline of quality assets from Ascott.”

“At the same time, we can earn fund management fees to complement third-party management contracts and franchises which we are looking to scale up sharply over the next few years. As we continue to pursue proactive capital recycling and investment strategies, we will enlarge and enhance our portfolio of assets to increase our return on equity.”

With this latest acquisition in Australia as well as the signing of 13 management and franchise contracts across China, France, Indonesia, Kenya and Vietnam, Ascott has achieved S$10 billion in asset value. These 14 new properties offer more than 2,200 units. Ascott has secured a total of over 10,600 units to date this year – double the number of units signed organically for the same period last year. Ascott has reached a total of more than 112,000 units in over 700 properties, on track to meet its global target of 160,000 units by 2023.

Mr Goh added: “Ascott will continue to ride on this growth momentum to achieve scale with our international network of well-known hospitality brands. We have more than 66,000 operating units and are targeting to open another 19 properties adding more than 2,800 units this year. We will continue to boost our fee income through growing our assets under management and lodging management business. Our strong management expertise, direct sales distribution channels, loyalty programme and digital transformation efforts will drive operational efficiencies at our properties, to support Ascott’s expansion through investments, management contracts, franchises, leases and strategic alliances.”

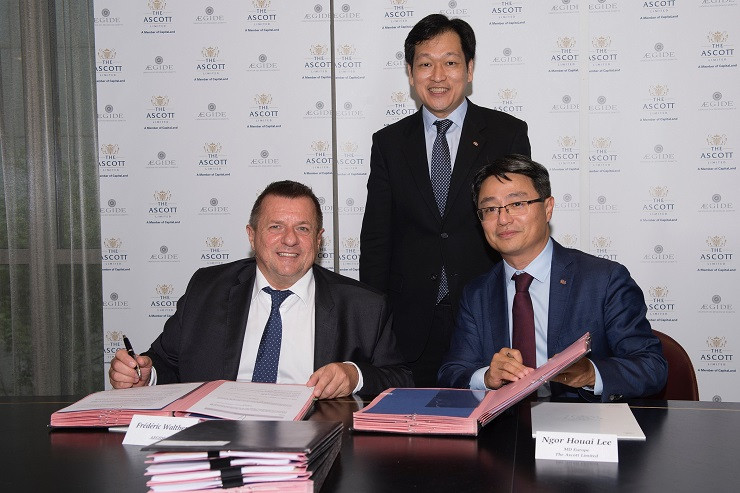

Among the 14 newly secured properties are four franchise agreements signed with Aegide Domitys, France’s leading provider of serviced accommodation for independent seniors. Citadines Connect City Centre Roanne is the first property in Europe under Ascott’s Citadines Connect brand of business hotels. Two properties, Hôtel Château Belmont Tours and La Clef Golfe-Juan, will be part of Ascott’s The Crest Collection and the fourth property is Citadines Toulouse. These four properties in France mark Ascott’s foray into three new cities – Golfe-Juan, Tours and Roanne, and will open from 2020 to 2023. Ascott and Aegide Domitys signed franchise agreements for Citadines Confluent Nantes and Citadines Eurometropole Strasbourg in 2017. Citadines Confluent Nantes has recently opened while Citadines Eurometropole Strasbourg will open in 2020. The signing ceremony between Ascott and Aegide Domitys also took place at the grand opening of La Clef Champs-Élysées Paris.

Of the nine new management contracts, Citadines IFC Shenyang and Citadines Huijin Nanxiang Shanghai are secured under Ascott’s strategic alliance with Nasdaq-listed Huazhu Hotels Group (Huazhu) and Huazhu’s subsidiary CJIA Apartments Group. To date, eight properties in China have been signed under this partnership.

Ascott has secured its first Yello-branded hotel in Vietnam with the signing of a management contract for Yello Phu Nhuan Ho Chi Minh City. Yello is one of six brands by TAUZIA Hotels Management (TAUZIA), which Ascott has a majority stake in. In addition, Ascott has sealed two management contracts in Bandung and Belitung in Indonesia under TAUZIA’s FOX and Vertu brands respectively.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.

![[PR] PR_Ascott and Vimut Hospital_2024](https://www.traveldailynews.asia/wp-content/uploads/2024/04/PR-PR_Ascott-and-Vimut-Hospital_2024-400x265.jpg)