Even if China were to reopen next year, the economic challenges currently facing the country – including a property market crisis and issues relating to the pandemic – would result in a slow travel recovery, particularly in the long-haul segment.

Valencia, Spain – As one of the last major hurdles to full global travel recovery, China’s continued absence from the international travel market has left many destinations facing a huge shortfall in tourist arrivals. ForwardKeys’ China Market Expert, Nan Dai, shares some insights on the opportunities with emerging markets in APAC.

Despite international travel to and from China having been restricted since the emergence of COVID-19, domestic travel has been permitted for some time. However, continuous lockdowns on major population centres, like Shanghai and Chengdu, following new coronavirus outbreaks have created a volatile domestic travel landscape. Recovery is fast when restrictions are lifted, but changes are frequent and sudden, and each lockdown has a significant effect on demand.

Given the problems facing China’s domestic travel market, and the government’s recent affirmation that it would maintain its cautious approach to COVID-19, the chances of the country reopening to international tourism in the short term appear slim. Nevertheless, it is worth remembering that similar policies, including travel bans, were widespread throughout the Asia Pacific until recently. Now that much of the region has reopened, it will be interesting to see whether local markets can keep COVID-19 rates under control. If they can, it may encourage China to reopen, gradually, in 2023 – as it will become increasingly difficult for the country to keep its borders closed when the rest of the region has returned to normality.

Yet even if China were to reopen next year, the economic challenges currently facing the country – including a property market crisis and issues relating to the pandemic – would result in a slow travel recovery, particularly in the long-haul segment.

Top Outbound APAC Markets to Consider

Until China’s outbound travel market fully reactivates, regional destinations that had developed a dependency on Chinese tourists in the years preceding the pandemic will need to shift their attention to other important markets.

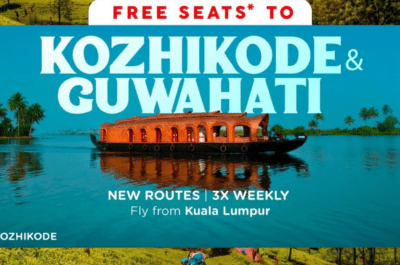

Among the top-five outbound markets in the Asia Pacific before the global health crisis, India shows particular promise. Although India’s size as an international outbound market is largely attributable to its significant global diaspora, its middle-class population is growing, and the number of outbound leisure travellers from the country is increasing as a result.

Moreover, while India’s intraregional outbound travel market is relatively small, it had experienced more growth (+10.4%) than any of the other major Asia Pacific outbound markets – both international and intraregional – over the five years before the pandemic. Now that the country has fully reopened, ForwardKeys expects its development as an interregional outbound market to accelerate.

The economic situation is also improving in Thailand, allowing more of its residents to travel abroad and thereby making the country an increasingly valuable source market for regional destinations.

Meanwhile, Japan and South Korea, the two top-performing outbound markets in the Asia Pacific (excluding China) before COVID-19, have recently reopened to travel and are expected to re-establish themselves as important source markets.

With China’s reopening seemingly still some time off, regional destinations need to adapt to the new environment, identifying markets and travel audiences to fill the gap left by China and contribute towards a long-term, sustainable tourism model.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.