Following the relaxation in travel restrictions in early 2022, new business from mainland Chinese customers grew by 110% to an estimated value of $1 billion during January–September 2022, thereby helping in partially offsetting the decline in the overall market.

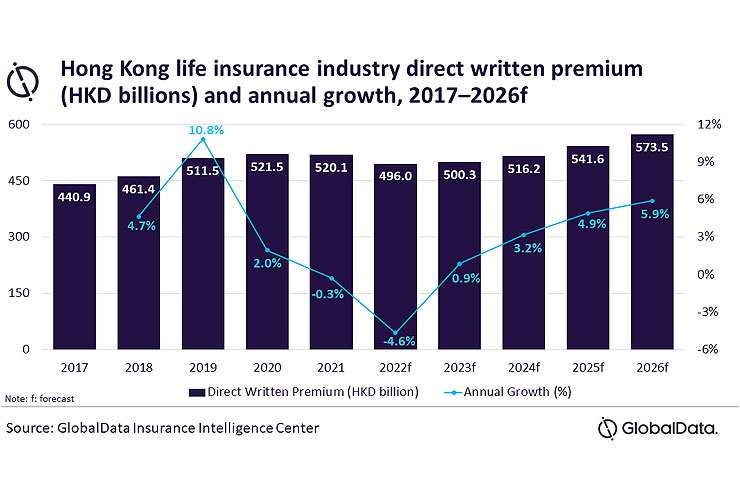

The Hong Kong life insurance industry is set to return to growth in 2023, after declining by 0.3% and 4.6% in 2021 and 2022, respectively, due to strict COVID-19 restrictions and economic slowdown. The recovery in the country’s life insurance market will be driven by ongoing positive economic developments and lifting of international travel restrictions, says GlobalData, a leading data and analytics company.

According to GlobalData’s Insurance Database, Hong Kong’s life insurance industry is estimated to record a compound annual growth rate (CAGR) of 3.5% in direct written premiums (DWP), increasing from HKD500.3 billion ($64.2 billion) in 2023 to HKD573.5 billion ($73.3 billion) in 2026.

Sravani Ampabathina, Insurance Analyst at GlobalData, comments: “Chinese residents are a prominent consumer segment for Hong Kong life insurers as life insurance products available to them in Hong Kong offer greater flexibility and higher returns compared to China. Due to post-pandemic travel restrictions, the share of business from Chinese customers declined in 2020 and 2021.”

However, following the relaxation in travel restrictions in early 2022, new business from mainland Chinese customers grew by 110% to an estimated value of $1 billion during January–September 2022, thereby helping in partially offsetting the decline in the overall market.

Ampabathina continues: “Favorable regulatory developments and the government measures to establish Hong Kong as a major financial hub will support the growth of life insurance in the country in the coming years.”

For instance, life insurance agents in Hong Kong are mandated to sell policies through face-to-face distribution channels only. However, in response to repeated COVID-19 break-outs, in September 2022, the Hong Kong Insurance Authority extended temporary measures allowing insurers and intermediaries to sell life insurance policies through non-face-to-face channels. This allowed customers to purchase life insurance products through digital distribution channels until April 30, 2023.

Ampabathina adds: “Life insurers are expected to further benefit from the ongoing developments in the Guangdong–Hong Kong–Macao Greater Bay Area (GBA). The GBA is a megacity consisting of nine urban cities and two special administrative regions in South China, with GDP exceeding $1.9 trillion in 2021, about nine times that of Hong Kong.”

In December 2022, the Hong Kong government suggested that insurers should re-engineer cross-border medical and critical illness products, to provide coverage for Hong Kong policyholders living, studying, traveling, or working in the GBA. The initiative will create an opportunity for insurers to expand their portfolios.

Ampabathina concludes: “The economic developments in the GBA, easing of travel restrictions and government support will help growth of life insurance business in Hong Kong over 2023-2026.”

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.