According to Baidu big data, 82% of employees in the F&B (Food & Beverage) and Hotels sectors have returned to work in March.

Do you know what Chinese are talking now? They are talking about ‘Revenge Spending’ (报复性消费). Revenge spending describes the huge buying desire by people whose pockets are flush with cash after weeks of lockdowns. In fact, revenge spending spurs Chinese luxury rebound from COVID-19 as we speak. Reference: https://www.bloomberg.com/news/articles/2020-03-12/luxury-shoppers-in-china-emerge-from-quarantine-to-buy-again

Along this emotion path, I predict ‘Revenge Traveling’ (报复性旅游) will happen next. Just based on the fact that Chinese outbound tourism has been booming before the COVID-19 crisis, how many overseas trips have been canceled by Chinese that they really want to go. While we say how much we miss the Chinese travelers since the outbreak, it holds true too how much they miss our sandy beaches, good food and fun time abroad.

So now, the question is when will revenge traveling happen?

On March 18, my company has conducted a webinar on China Tourism Recovery and provided some insights on this based on various sources of data. I am going to share it here.

On the bigger scheme of things, China seems to be stabilising. According to Baidu big data, 82% of employees in the F&B (Food & Beverage) and Hotels sectors have returned to work in March. This is a good sign to show life is resuming normal gradually in China.

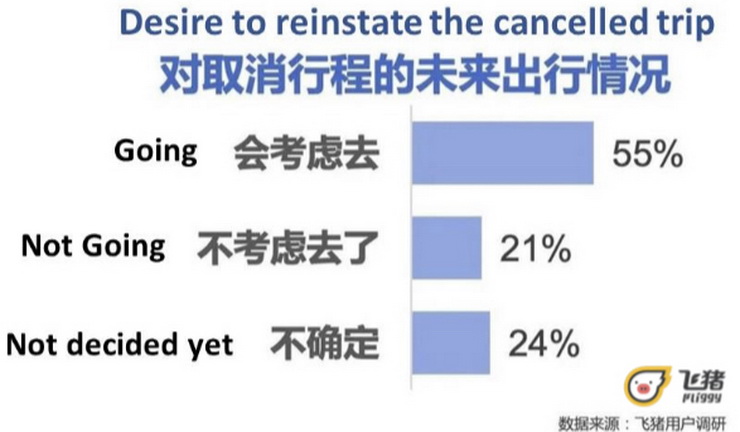

Diving into the tourism sector, Fliggy (the online travel platform owned by Alibaba) surveyed those who booked and canceled the trips due to COVID-19 and 55% indicates they will reinstate the canceled trips. Only one-fifth said they will not be going.

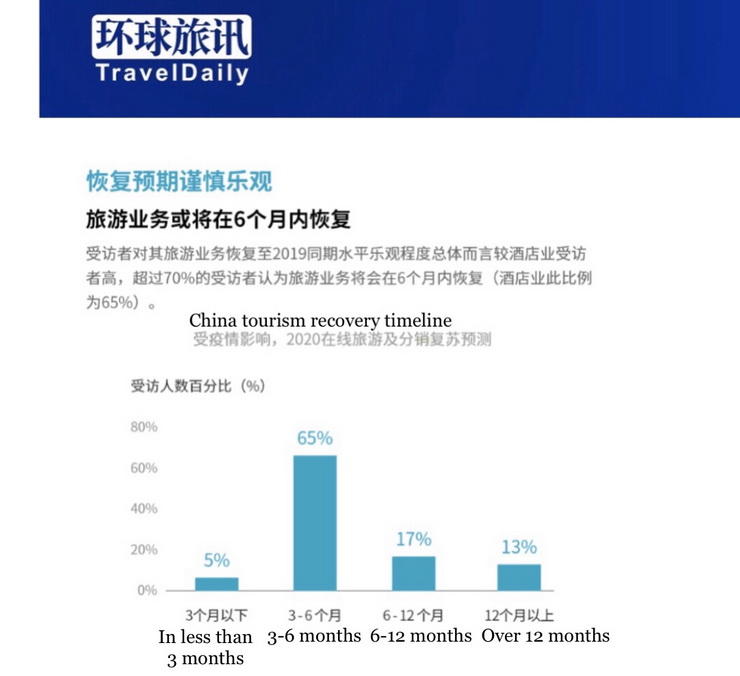

According to TravelDaily, 65% of the surveyed believe China tourism will rebound within 3 – 6 months from now.

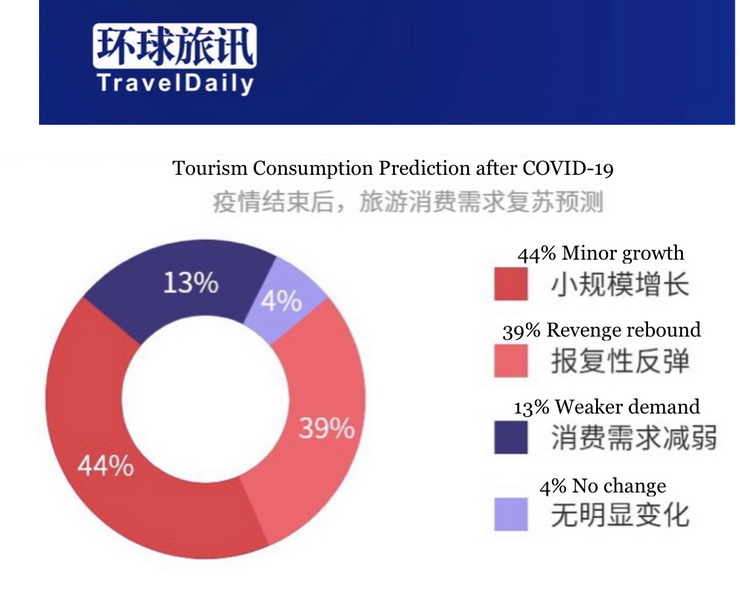

And 39% predicts it will be revenge type of rebound, 44% believes it will be minor rebound but altogether it is a 83% positive outlook on China tourism consumption post COVID-19.

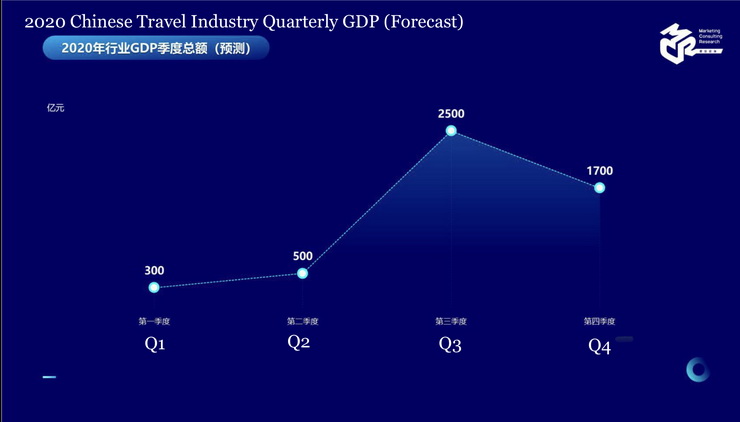

Then in a report published by Marketing Consulting Research (MCR) that studied the COVID-19 impact of various industries in China, under Chinese Travel Industry sector, it sees slight improvement in Q2 but a spike in Q3 carrying through to Q4.

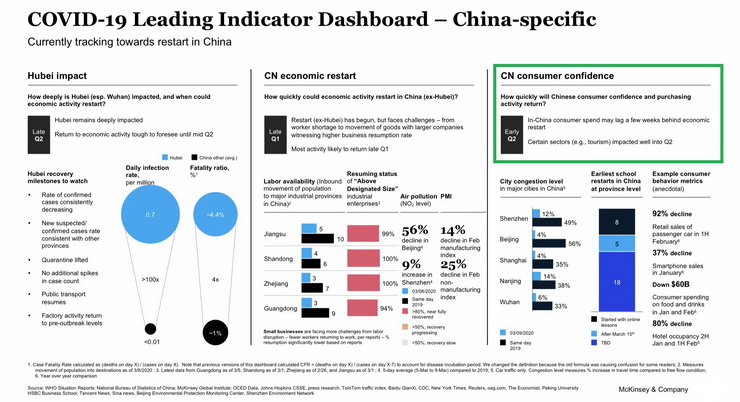

As well in the McKinsey & Co’s COVID-19 Leading Indicator Dashboard – China Specific that was last updated on March 9, it also shows CN economy restarts in late Q1 and CN consumer confidence will return in early Q2 specifically the tourism sector will impact well into Q2.

A recent survey conducted by PATA, IVY Alliance & China Comfort Travel found from respondents that if COVID-19 is under control by April, 60% will travel. And 32% of the respondents are already planning for July, August summer trips.

The top ten (10) outbound destinations after COVID-19 are Japan (18%), Thailand (14%), Europe (14%), Maldives, Singapore, New Zealand, Australia, South Korea, Sri Lanka & Malaysia.

From what we gathered from various sources, it is fair to predict China outbound market can rebound as early as late Q2, a small peak in July / August and carrying it through to Q4. Now it really depends on how fast each country is containing COVID-19 and put in under control and how soon the travel restrictions each country will lift to see when ‘revenge traveling’ becomes reality.

We are all in survival mode, I know how challenging the situation is for the hospitality and tourism industry. But I am not giving up. I hope China that is the first market to explode will be the first market to recover and this market can save our hotels in 2020. To end, a line taken from Reuter: Communications report summary, “As China is on the road to recovery, brands are reactivating their marketing and communications.” So are we.

Anita Chan is the CEO of Compass Edge. Anita worked for hotel chains, hotel representation companies in Canada, digital agencies for hospitality industry and leading OTA in Asia, soft brand company in Europe before joining Compass Edge.