It is found that nearly one-third of Greater China tourists visit the same destination more than once per year, while

Mainland China tourists have got the most frequent tourists.

SINGAPORE – According to UNWTO/GTERC, APAC ranks after Europe as the second largest source for international tourism, contributing to nearly 40% of world’s international tourism expenditure. North-Asian regions are the main contributors to Asia tourism in international tourist departures, taking up the top six places in APAC’s rank (excluding India). Both South Korea and Taiwan have recorded a double-digit growth for two consecutive years, while Mainland China remains to be the world’s biggest spender, with nearly 10 times international tourism expenditure of South Korea.

Interestingly, intra-regional tourism is particularly strong in boosting international travel and tourism economy, consuming about four out of five (80%) arrivals worldwide. Acknowledging the inevitable growth of Asia and intra-regional tourism, Vpon Big Data Group, the Asia’s leading big data ad tech company, releases its latest APAC Mobile Advertising Statistics and Trends Report. Supported by Vpon’s Trata DMP which possesses 60 million Asian tourist’s behavior data, the report throws light on the mobile behavior of Greater China (Mainland China, Hong Kong and Taiwan) tourists traveling to Singapore, Japan and Thailand, as well as the latest APAC mobile programmatic advertising statistics and trends.

Mainland China Tourists – the Frequent Tourists to Singapore

It is found that nearly one-third of Greater China tourists visit the same destination more than once per year, while Mainland China tourists have got the most frequent tourists. Particularly, one out of three Mainland China tourists who are defined as frequent tourists hit Singapore three times or above, taking up a larger proportion than tourists from Hong Kong (24%) and Taiwan (8%).

Data also shows that general tourists from Greater China region prefer a shorter trip (6 days on average) in intra-regional tourism. Yet, frequent tourists tend to stay longer for 0.6 to 2.6 days per trip. Mainland China frequent tourists stay averagely 29.2 days or above in Singapore throughout the year.

Singapore – the Best Place to Travel during Summer Vacation

Apart from summer holiday (July to August) being the peak season for Greater China tourists to travel abroad, Mainland China and Hong Kong tourists flock to travel destinations during local festive seasons, such as Oct-1 Golden Week, Easter, Christmas, etc. By contrast, Taiwan tourists are less subjected to festivals.

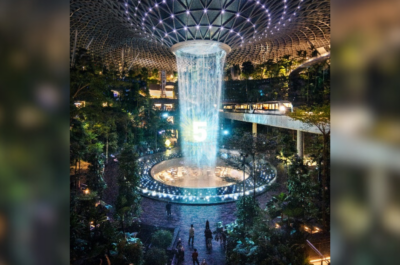

In Singapore, footprints are densely concentrated around Marina Bay, indicating the area remains to be a must-go spot for Greater China tourists. Adding on, Hong Kong and Taiwan tourists have been exploring hidden gems in the country, resulting in a more scattered footprint distribution across the map.

Greater China Tourists’ Mobile Behavioral Change from Pre- to During-Trip Stages

Subtle changes can be observed from data showing Greater China tourists are generally active in using their mobile devices during travel. Mainland China and Hong Kong tourists engaged more with their mobile devices during daytime, especially around meal hours. The mobile activeness for Taiwan tourists soars from early evening to mid-night across all three destinations.

Greater China tourists’ ad preference appears to be more consistent at pre-trip stage, but varies more at during-trip stage across all three destinations. It is seen that their ad preference changes in accordance to the destinations they are traveling. For example, Mainland China tourists engage more with computer & electronics ad, while Hong Kong tourists engage more with health care ads before trip. Both appears to have a different ad preference at during-trip stage — Mainland China tourists engage with family & parenting ads in both Singapore and Thailand, but apparel & accessories ads only in Japan; Hong Kong tourists engage with telecommunication and family & parenting ads in both Japan and Singapore but automotive and vehicles ads only in Thailand.

“What we advise, based on these data insights, is advertisers should adopt different approaches in engaging tourists at different stages of their journey. For instance, general tourists are more preferable to be targeted from pre- to during-trip as a one-off approach, while frequent tourists are preferable to be targeted by on-going communication through the entire journey,” said Arthur Chan, Chief Operating Officer at Vpon.

“Thanks to the ever-connectedness of mobile devices, a massive amount of quality data generated by on-the-go consumer activities on mobile devices makes big data effective for brands to gain a comprehensive understanding on user behavior and to predict the trend …Vpon dives into multi-dimensional mobile data of Asian tourists and turns it into actionable insights for brands to further refine their marketing strategies. Empowered by big data insights, brands are able to achieve better ROI and strong customer base by advanced precise targeting,” said Victor Wu, Chief Executive Officer at Vpon.

Mobile App Still Dominates the Mobile Ad Inventory in APAC

Data shows India and China generate the most biddable inventory in mobile advertising, occupying 46% in APAC. While mobile app (66%) takes up a bigger proportion than mobile web (34%). Southeast and South Asian regions have higher mobile ad inventory than average.

For mobile advertising format, despite banner ad remains to be the major ad format (53%) in APAC, native ad has grown in its popularity and obtained a considerable share among others.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales. She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.